Free Financial Management Plan Template – In the present quick-moving world, overseeing funds effectively is critical for getting a steady future. Whether you’re going for the gold, putting something aside for a fantasy excursion, or planning for your youngsters’ schooling, having a very much organized financial management plan is the way to progress. To help you in this undertaking, we present our far-reaching Free Financial Management Plan Template.

What is a Financial Management Plan Template?

Before jumping into the Financial Management Plan Template, we should understand what a financial management plan is and why it’s fundamental. A financial management plan is a diagram that frames your financial objectives, evaluates what is happening, and sets down systems to accomplish those objectives. It incorporates planning, saving, financial planning, and obligation management, custom-made to your specific necessities and goals.

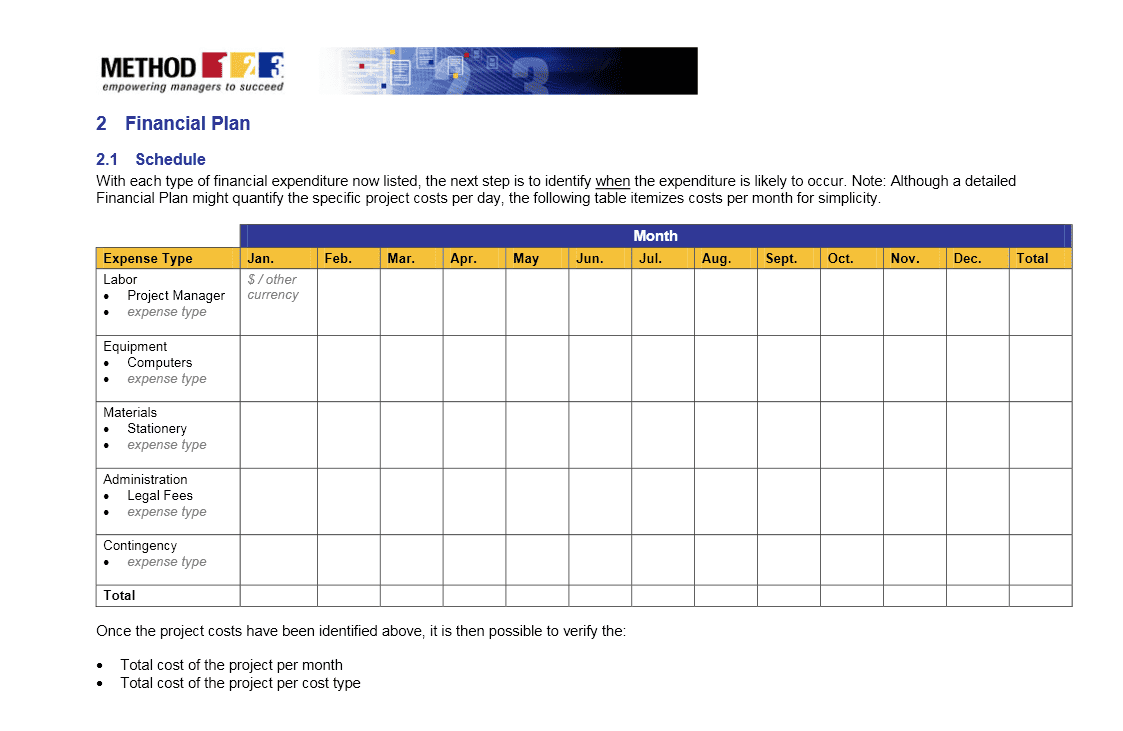

Financial Management Business Plan Template (1st Free Basic Format)

Raise your financial management game with our business plan template intended to assist you with smoothing out your funds and accomplishing your objectives. This thorough Financial Management Plan Template remembers areas for planning, income gauging, risk management, and vital planning.

With simple adherence to directions and adaptable elements, you can fit this Financial Management Plan Template to accommodate your one-of-a-kind business needs. Assume command over your financial future and make smart, information-driven choices with our Financial Management Business Plan Template.

Free Financial Risk Management Plan Template

Could it be said that you are fed up with feeling like you have zero influence over your funds? Would you like to ensure you have a plan set up to safeguard yourself against unforeseen financial risks? Look no further!

We will examine the significance of having a financial risk management plan and give you a template to assist you with getting everything rolling.

For what reason do you want a financial risk management plan?

Life is brimming with vulnerabilities, and no one can tell when a financial emergency could hit. Whether it’s terrible work, confronting startling clinical costs, or encountering a cataclysmic event, having a strong financial risk management plan set up can assist you with enduring the hardship. By distinguishing likely risks and making a plan to moderate them, you can shield yourself and your friends and family from financial difficulty.

What should a financial risk management plan incorporate?

An extensive financial risk management plan ought to incorporate the following parts:

- Risk evaluation: Recognize potential risks that could adversely influence your funds, like employment misfortune, ailment, or market variances.

- Risk investigation: Assess the probability and expected effect of each distinguished risk.

- Risk moderation techniques: Foster a plan to limit the effect of each risk, for example, constructing a secret stash, buying protection, or enhancing your speculations.

- Checking and audit: Routinely survey your financial risk management plan to guarantee it stays exceptional and viable.

Financial Risk Management Plan Template (2nd Main Choice)

To assist you with getting everything rolling with making your financial risk management plan, we have given a financial management plan template that you can use as an aide:

Risk appraisal:

- List potential risks that could affect your funds (e.g., employment misfortune, market instability, well-being crises).

- Gauge the probability and possible effect of each risk.

Risk examination:

- Assess the likely effect of each risk on your financial objectives and solidness.

- Focus on risks in light of their probability and effect.

Risk alleviation techniques:

- Foster a plan to moderate each recognized risk (e.g., building a secret stash, buying inability protection, broadening ventures).

- Set specific activity steps and timelines for executing every procedure.

Observing and survey:

- Routinely survey and update your financial risk management plan to guarantee it stays relevant and viable.

- Change your plan depending on the situation in light of changes in your financial circumstance or outside factors.

By making a financial risk management plan and following the Financial Management Plan Template given, you can assume command over your funds and safeguard yourself against unforeseen risks. Try not to hold on until it’s past the point of no return – begin planning for your financial future today!

Get also: Free Personal Financial Plan Template Excel

Why You Want a Financial Management Plan Template

1. Objective Setting and Prioritization

A financial management plan assists you with characterizing your present moment and long-haul financial objectives. Whether it’s purchasing a house, beginning a business, or resigning serenely, distinguishing your goals is the most vital move towards financial achievement. Also, it helps with focusing on these objectives in light of their significance and possibility.

2. Financial Mindfulness and Responsibility

By making a financial management plan, you gain a more profound understanding of your pay, costs, resources, and liabilities. It cultivates financial mindfulness, empowering you to follow where your cash proceeds to recognize regions for development. Furthermore, having an organized plan makes you responsible for your financial choices, guaranteeing capable cash management.

3. Risk Management and Possibility Planning

Life is unusual, and financial crises can emerge unexpectedly. A very much-created financial management plan incorporates arrangements for risk management and possibility planning. Whether it’s structuring a rainy day account, acquiring protection inclusion, or differentiating ventures, these actions shield your financial soundness in times of emergency.

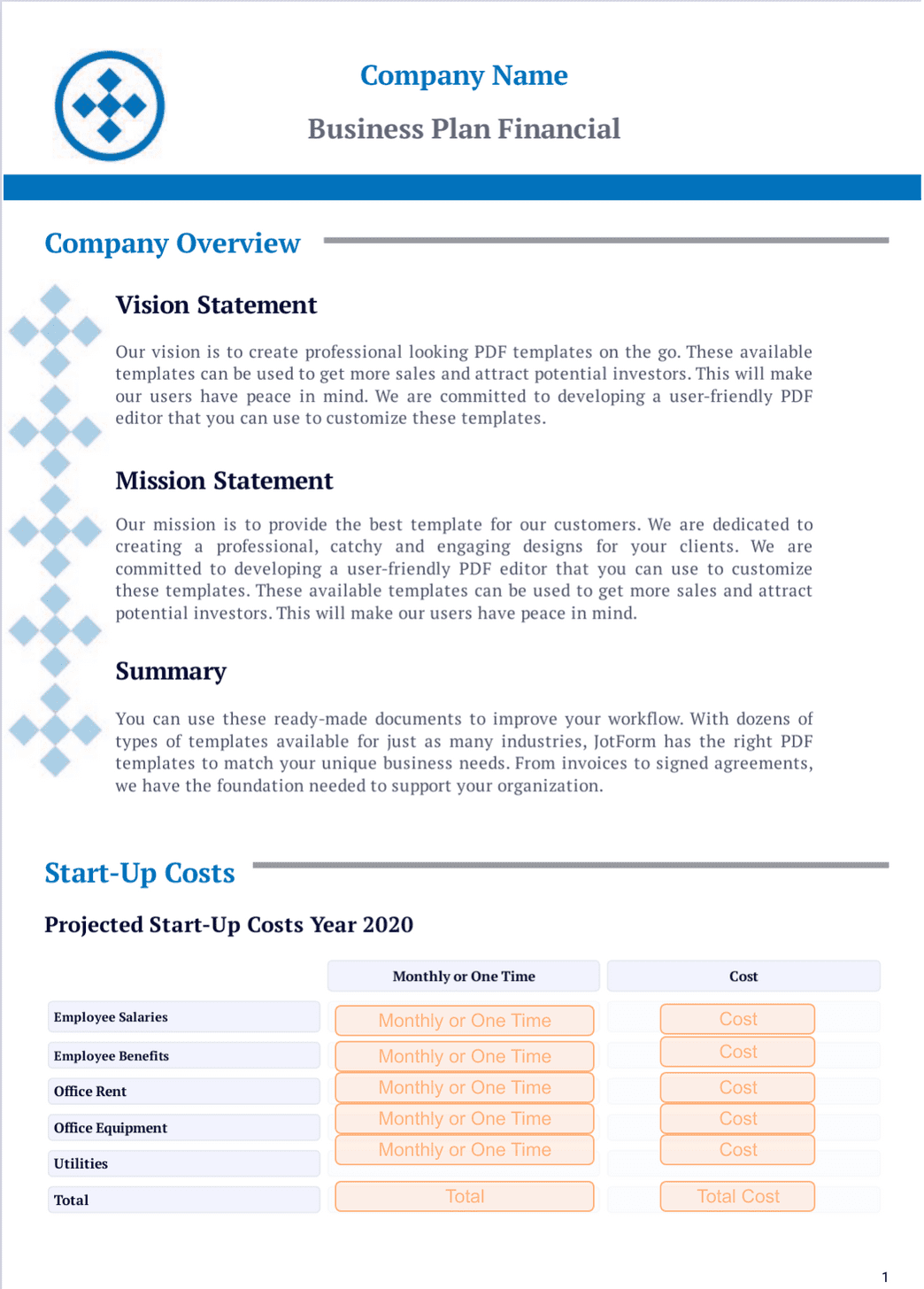

Parts of Our Free Financial Management Plan Template

Now that we understand the significance of a financial management plan, we should dive into the parts of our exhaustive template:

1. Financial Objectives Worksheet

This segment assists you with articulating your financial objectives, both present moment and long haul. It prompts you to determine the targets, set cutoff times, and dole out needs to every objective. Whether it’s taking care of obligation, putting something aside for retirement, or putting resources into advanced education, this worksheet fills in as a guide for your financial excursion.

2. Pay and Cost Tracker

Understanding your income is fundamental for successful financial management. Our template incorporates a point-by-point pay and cost tracker, permitting you to carefully screen your profit and consumption. By ordering costs and distinguishing spending designs, you can pursue informed choices to enhance your financial plan and expand investment funds.

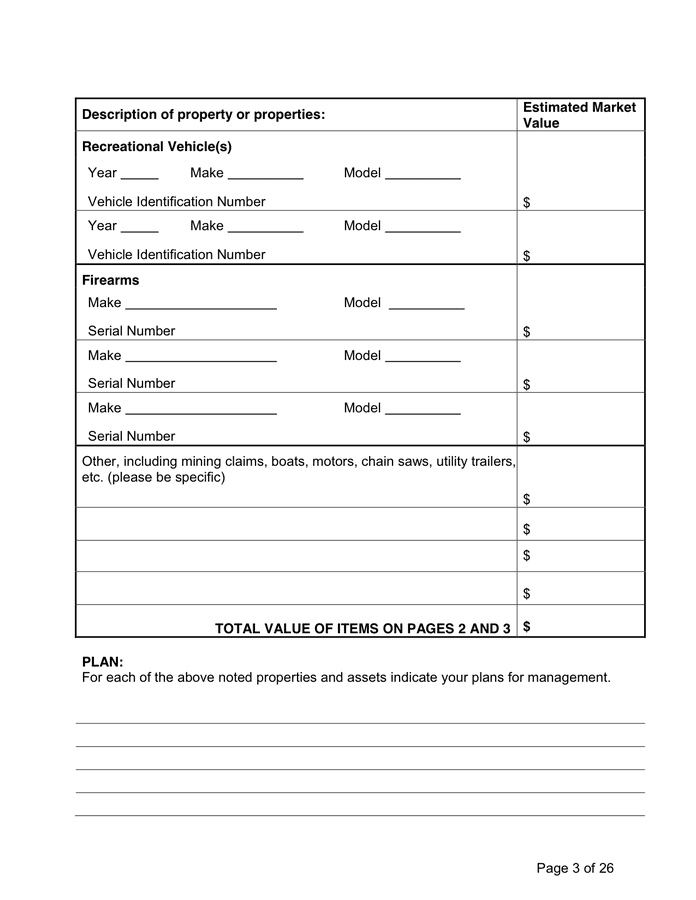

3. Total assets Proclamation

Your total assets are an impression of your financial well-being, addressing the contrast between your resources and liabilities. Our Financial Management Plan Template helps you work out and break down your total assets intermittently. Following changes in your total assets after some time gives significant bits of knowledge into your financial advancement and illuminates key acclimations to accomplish your objectives.

4. Planning Device

Planning is the foundation of financial planning, empowering you to distribute assets productively and abstain from overspending. Our planning device engages you to make a personalized spending plan because of your pay, costs, and reserve funds targets. With adjustable classes and cost following highlights, you can remain restrained and accomplish financial discipline.

5. Speculation Portfolio Tracker

For those wandering into the universe of financial planning, our venture portfolio tracker works on the most common way of checking and dealing with your speculations. From stocks and securities to common assets and land, this instrument permits you to follow resource designation, screen execution, and rebalance your portfolio on a case-by-case basis. Whether you’re a fledgling financial backer or an old pro, this tracker streamlines your speculation technique.

6. Obligation Reimbursement Plan

Obligation can be a critical deterrent to financial freedom, however, with an organized reimbursement plan, you can vanquish it deliberately. Our obligation reimbursement plan template assists you with coordinating your obligations, focusing on reimbursement methodologies, and tracking progress toward becoming obligation-free. Whether it’s understudy loans, Mastercard obligations, or home loan installments, this apparatus gives clearness and inspiration on your excursion to financial freedom.

Get also: Free Budget Plan Template Printable

Conclusion

In conclusion, a very well-planned financial management plan is fundamental for accomplishing your financial objectives and getting a prosperous future. Our Free Financial Management Plan Template offers a complete system to survey what is happening, put forth achievable objectives, and carry out methodologies for progress.

By utilizing this Financial Management Plan Template, you can assume command over your funds, create financial momentum, and understand your fantasies. Download our Financial Management Plan Template today and set out on your way to financial freedom!